| IN VERY BRIEF Apply in your company. Get the MAKE PROGRESS® implementation roadmap. Build your Growth Machine. Get your toolkit . Master these techniques. Buy MAKE PROGRESS®, the book |

“In a complex and rapidly changing world, only continuous progress can keep us ahead.”

Daniel Li, CEO of Geely Holding Group

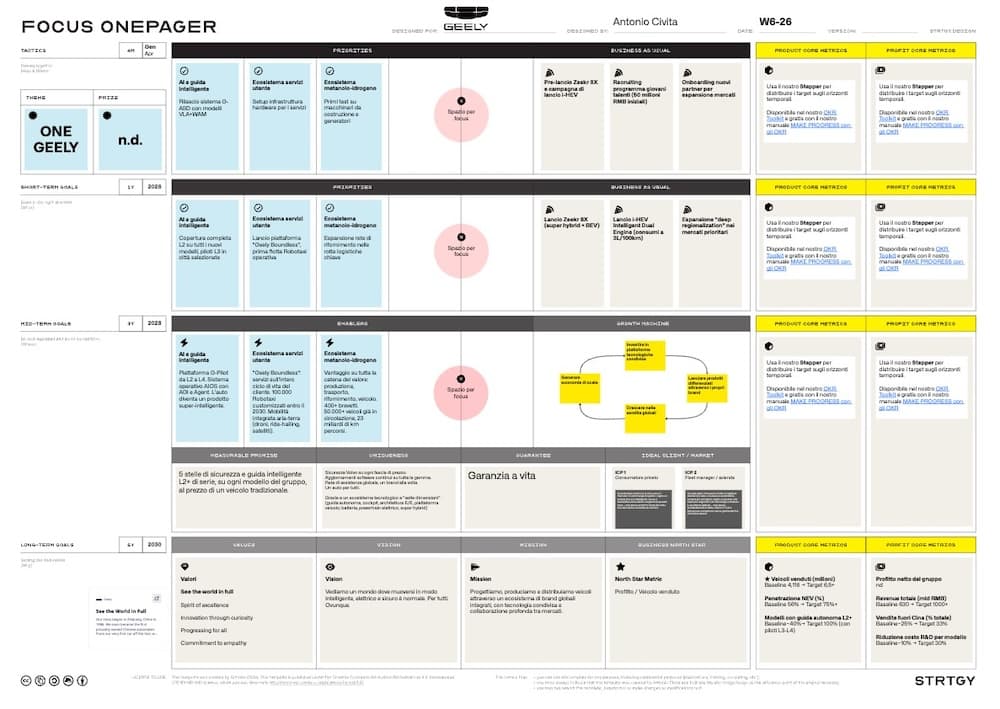

Geely Holding released its five-year strategic plan last Wednesday.

Global brands, ecosystems, solid-state batteries, robotaxis, methanol engines, satellites. A dense, ambitious document, packed with numbers.

It’s a press release, of course. But reading it, I wondered: how would the communication of this strategy have changed if they had used the MAKE PROGRESS® tools?

Small disclaimer: I don’t work at Geely. I have no confidential information. This is a strategy reverse engineering exercise, done entirely with public information.

Strategy is the most visible aspect of any organization. You can read it in the products it launches, the markets it enters, the partnerships it forges, and the numbers it reports.

One of the things I’m most passionate about is helping companies build sustainable strategies that allow them to avoid the pressure of competition. And to do so, I use the exact same tools both to design strategies and to reverse engineer those of others.

That’s why at STRTGY, we’re building MAKE PROGRESS® as a shared standard for strategy execution. A standard that accelerates the quality of thinking and the speed of action. One that allows you to zag when everyone else zigs.

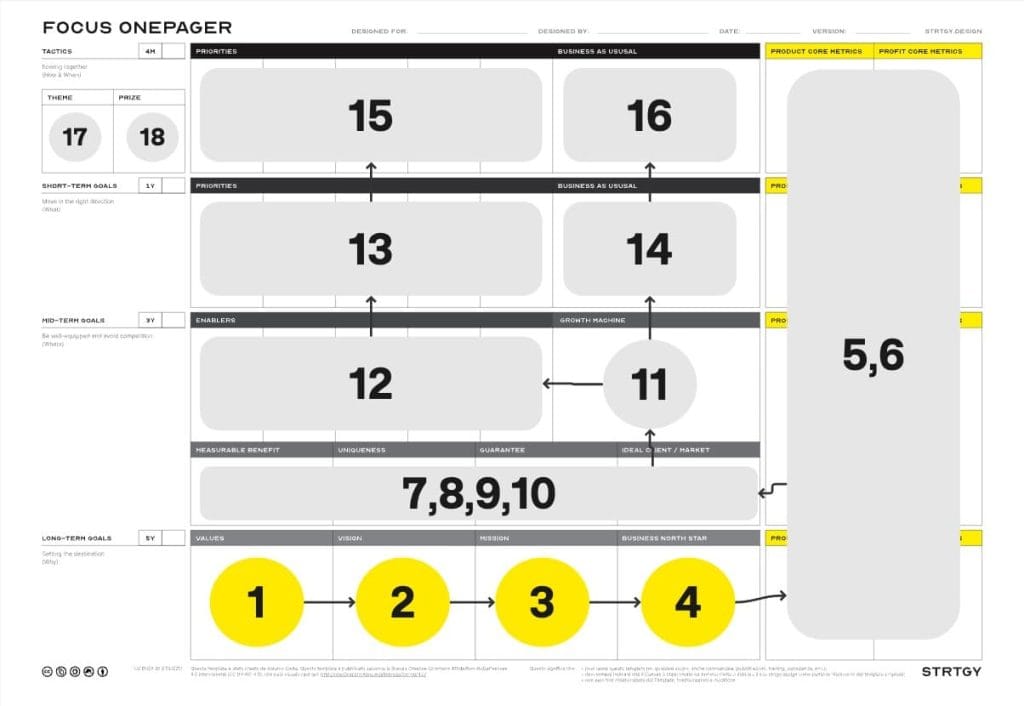

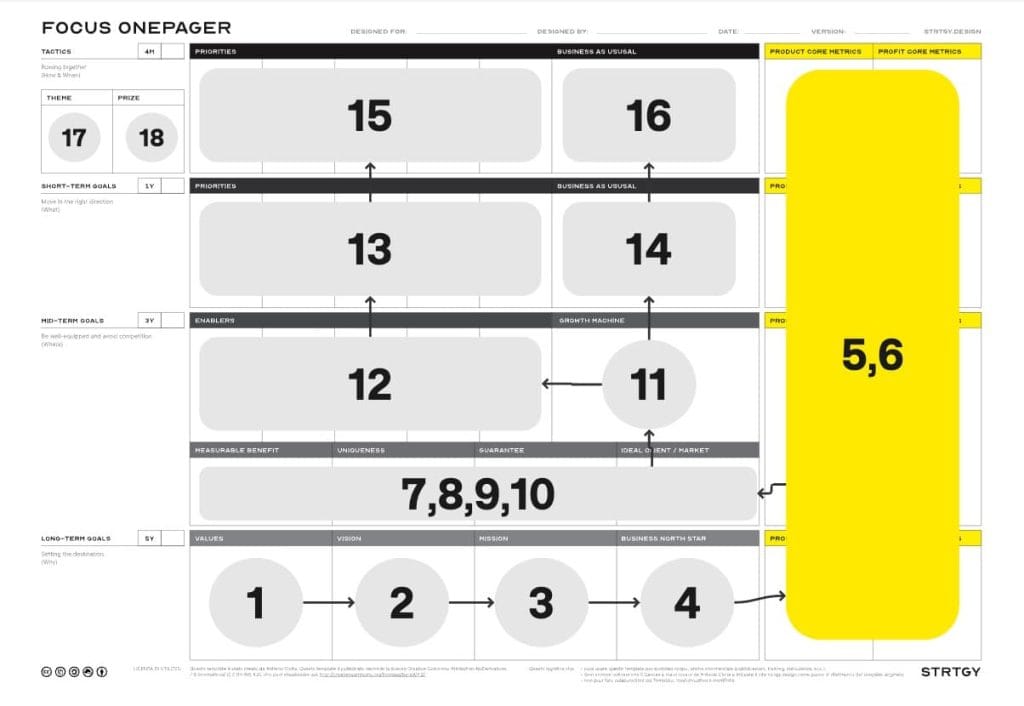

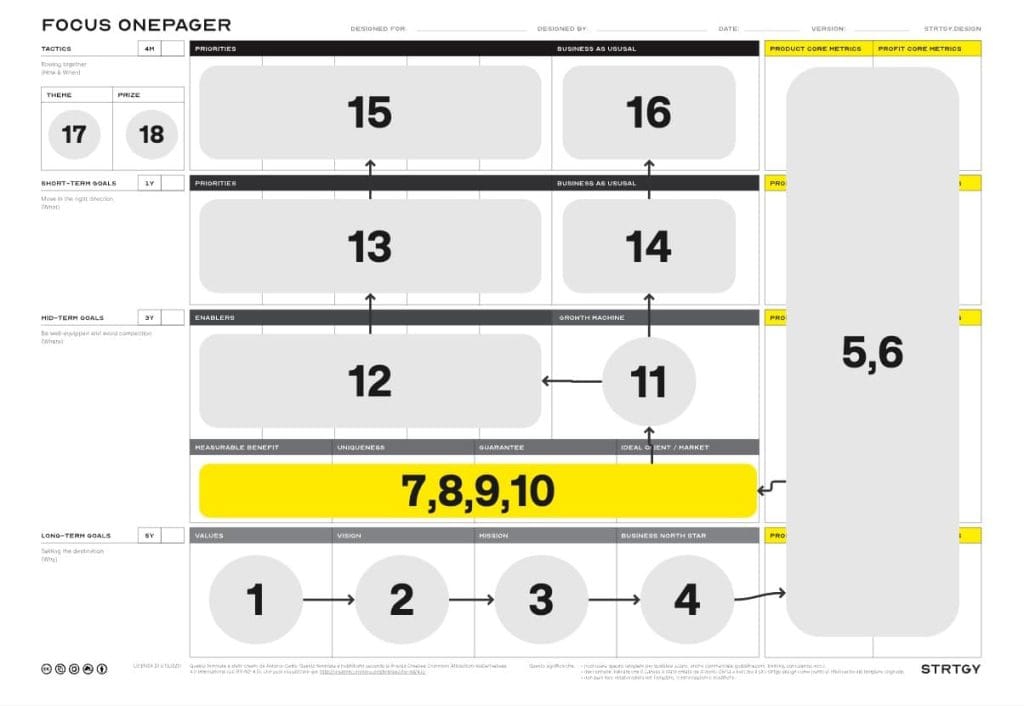

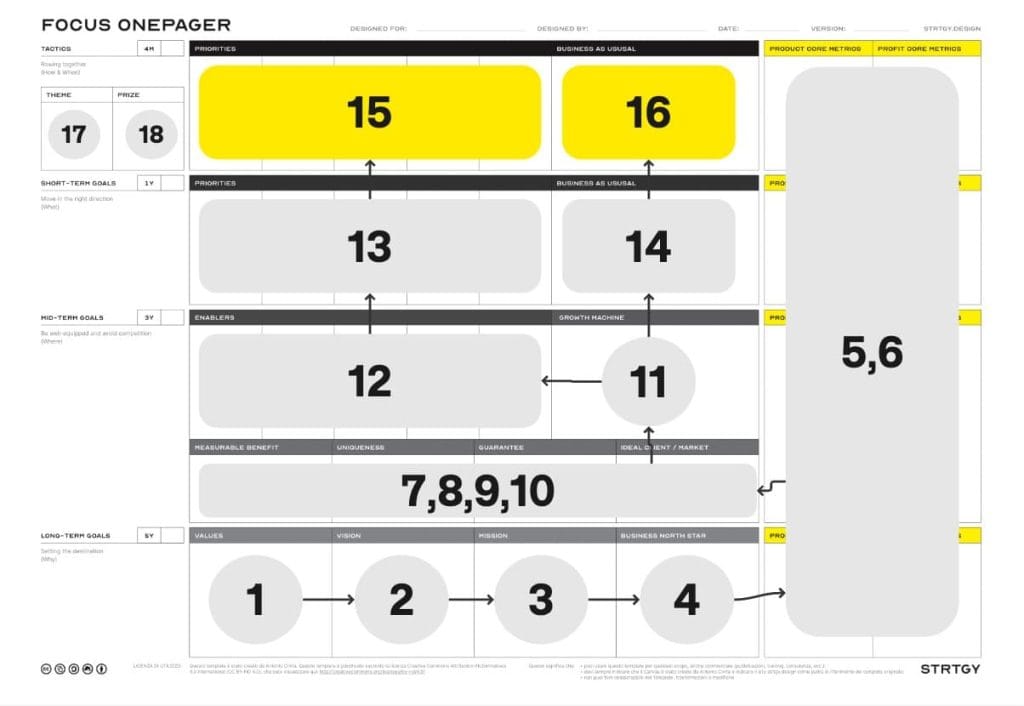

The tool I’m showing you today with this real-world case study is called Strategy Focus Onepager. It works with multinationals with billions in revenue and teams of just three people.

And today I’m showing it to you piece by piece, compiled with real Geely data.

Why just one page?

An organization’s strategy doesn’t fail because it’s wrong. It fails because no one understands it.

Hundreds of slides. Spreadsheets with formulas few can explain. Documents no one rereads after the first quarter. Words that mean different things to different departments.

The Focus Onepager solves this problem. If the strategy doesn’t fit on one page, it’s not clear enough. And if it’s not clear, it won’t be executed.

Each section represents a strategic decision. Every decision has a specific place. Let’s start from the bottom, at the deepest level.

Values

What behaviors do we need to adopt to execute this strategy?

In the MAKE PROGRESS® method, values aren’t motivational posters hanging in the cafeteria. They’re the codification of positive behaviors the organization must foster to execute its strategy. They are operational culture: if the strategy dictates where to go, the values dictate how to behave along the way. When culture and strategy don’t match, the strategy fails.

Geely doesn’t explicitly publish its internal corporate values. But we can find them in the group’s brand values , declared under the “See the world in full” manifesto. These are brand values, of course, but in a coherent organization, brand values reflect internal values, because you can’t promise the market something you don’t practice internally.

Here they are, and the strategic behavior each enables:

- Spirit of excellence. Obsession with quality. It’s the value that makes the lifetime guarantee possible: if you don’t design components that last forever, that promise will destroy you.

- Innovation through curiosity. Continuous experimentation. This is the driving force behind enablers (AI, methanol, and service ecosystems). Without institutionalized curiosity, investments in shared platforms stop at the first version.

- Progressing for all. Inclusive progress. It’s the value that justifies scale: from the Lotus supercar to the Galaxy city car, the best technology must be accessible to all segments. No brand is left behind.

- Commitment to empathy. Deep customer listening. This is the value that fuels go-to-market based on the job to be done: don’t build for demographic segments, build for real-world situations.

Four values. Four behaviors. If you remove any one of these, at least one section of the Focus Onepager stops working. And that’s exactly how you test whether your values are real or just meaningless words: if you remove them and the strategy still holds up, they’re not values, they’re slogans.

Vision

What is our vision of a better world for our customers?

We envision a world where moving intelligently, electrically, and safely is normal. For everyone. Everywhere.

This is the filter. Any decision that doesn’t come close to this sentence is noise.

A note on language: in the Chinese automotive industry, pure electric vehicles, plug-in hybrids, and fuel cell vehicles are grouped under a single acronym: NEV (New Energy Vehicle). You’ll often find it in this newsletter.

Mission

What do we do, incredibly well, to realize the vision?

We design, manufacture and distribute vehicles through an ecosystem of integrated global brands, with shared technology and deep collaboration across markets.

Geely has chosen “One Geely, Leading through Innovation and Integration” as its strategic slogan. This phrase embodies the most important decision of the five-year plan: to stop each brand operating independently and begin sharing technology, supply chains, and markets across all the group’s brands (Geely, Volvo, Zeekr, Polestar, Lotus, Lynk & Co, Galaxy). The mission translates that slogan into concrete action: what we do, every day, to realize the vision.

North Star Metric

What is the one number that predicts our success?

Geely is a sales-driven organization. The North Star Metric I would choose is:

Profit per vehicle sold

Because this metric is, in fact, three metrics in one is because it is a ratio , and ratios are among the most useful metrics for understanding the performance of a system.

Profit per vehicle sold is a ratio. And like any ratio, it tells a story with two sides:

- Success for the company : they are generating profit. Production efficiency, pricing power, product mix, and R&D costs are under control.

- Customer success : People want those cars. They buy them. They come back for more. They recommend them.

When profit per vehicle sold increases, it means Geely is doing both: building a profitable company and making customers happy. People recognize good cars. If the number goes up, the strategy is working.

But the true power of this metric emerges when you cross it with volume. Here are the strategic cases.

If vehicles sold increase

Profit per vehicle grows

The best case scenario. More customers, higher margins for each. The Growth Machine is turning, and the company is capturing value. Healthy, scalable, sustainable growth.

Profit per vehicle is stable

A good sign. The company is scaling without sacrificing margins. The cost structure is supporting volume. This is a sign that shared platforms and economies of scale are working.

Profit per vehicle drops

Warning signal. They’re selling more, but at what price? Aggressive discounts, low-margin markets, costs rising faster than revenues. Growth that destroys value. Vanity metrics.

If vehicles sold remain stable

Profit per vehicle grows

They’re extracting more value from the same base. Better product mix, stronger pricing power, falling costs. It’s pure optimization. Often the prelude to an expansion phase.

Profit per vehicle is stable

Stagnant. The company isn’t getting worse, but it’s not getting better. In a fast-moving market like the automotive industry, stagnating is equivalent to losing ground.

Profit per vehicle drops

Serious problem. Same volumes, lower margins. Costs are rising (raw materials, R&D, logistics) or the market is compressing prices. The company is losing competitiveness without its sales figures yet reflecting it.

If vehicles sold decrease

Profit per vehicle grows

A deliberate strategy or a mixed signal. It could be a choice: exit low-margin segments and focus on premium. Or it could be that customers are leaving and the company is masking the problem by raising prices. Understanding the context is key.

Profit per vehicle is stable

The market is shrinking, but the company is holding its margins. Resilience is expected in the short term, but if volume continues to decline, fixed costs will begin to weigh heavily.

Profit per vehicle drops

The worst case scenario. Fewer customers, lower margins. The company is losing on both fronts: the market doesn’t want the products, and the cost structure isn’t sustainable. This requires radical strategic intervention.

This is why profit per vehicle sold is the North Star Metric. It doesn’t just tell you “how things are going.” It tells you where you’re going , which direction the car is moving, and whether you’re creating real value or just the illusion of progress.

Product Core Metrics

Which 3 numbers measure product growth?

Product Core Metrics answer a simple question: is your product growing? They’re the numbers that measure whether what you offer is working, whether customers want it, and whether you’re going in the right direction. In a Focus One-Pager, you only need three. If you can’t choose three numbers that reflect the health of your product, you probably haven’t figured out what you’re really selling.

| Metrics | Baseline 2025 | Target 2026 | Target 2030 | Notes |

|---|---|---|---|---|

| Vehicles sold (millions) | 4,116 | ~4.8 | 6,5+ | Contained in the NSM |

| NEV Penetration (%) | 56% | ~62% | 75%+ | Measure the transition to electric |

| Models with L2+ autonomous driving (%) | ~40% | 100% new models | 100% (with L3-L4 pilots) | From the G-Pilot plan: L2 coverage on all new models |

4.116 million vehicles by 2025, +26% year-over-year. Five consecutive years of growth. The seventh-largest automotive group in the world, the fastest among the top ten.

Profit Core Metrics

Which 3 numbers guarantee financial sustainability?

| Metrics | Baseline 2025 | Target 2026 | Target 2030 | Notes |

|---|---|---|---|---|

| Group net profit | nd | nd | nd | Contained in NSM but not publicly available: Geely Holding is not listed |

| Total revenue (RMB billion) | ~630 | ~720 | 1.000+ | Declared in the plan: target “1 trillion” |

| Sales outside China (% of total) | ~25% | ~28% | 33%+ | Declared: “more than one-third” |

| Reduction in R&D costs per model | nd | -10% | -30% | Declared: “over 30%” thanks to shared platforms |

Profit Metrics answer another question: is the company sustainable? You can have the best product in the world, but if it doesn’t generate enough economic value, the machine grinds to a halt. These metrics measure whether the strategy is producing real financial results. As with Product Core Metrics, you only need three.

Total revenue: ~630 billion to 1,000+ billion RMB

In 2025, Geely’s revenue was approximately RMB 630 billion (~$87 billion). The five-year plan aims to exceed RMB 1 trillion by 2030, the famous “trillion.” How do they get there? With two levers: selling more vehicles (from 4.1 to 6.5 million) and selling higher-margin vehicles (more NEVs, more premium vehicles, more Zeekrs and Polestars in the mix). It’s not just “selling more.” It’s shifting the revenue focus toward higher-value products.

Sales outside China: from ~25% to over a third of total

Today, Geely sells about three-quarters of its vehicles in China. The problem is that the Chinese market is the most competitive on the planet: price wars, compressed margins, over 100 brands competing for the same customers. The strategy is clear: expand abroad, where margins are higher and competition is less fierce. And here, Geely has an ace up its sleeve that no other Chinese manufacturer has: it already owns global brands. Volvo sells in Europe and the United States. Polestar is present in 27 markets. Lotus is a British luxury brand. They don’t have to build their international presence from scratch; they have to use what they already have. The “deep regionalization” strategy means exactly that: using each brand as a bridgehead in the market where it is strongest.

Reduction in R&D costs per model: -30% by 2030

This is the number that captures the promise of “One Geely.” Today, each brand in the group develops its own models with varying degrees of independence. Different platforms, different architectures, different suppliers. Geely wants to overturn this model: creating shared NEV architectures covering the A to E class, so that developing a new model costs 30% less than today. This isn’t just cost-cutting. It’s the dividend of integration. If you share the platform between Zeekr, Galaxy, and Geely Auto, the development costs of each model plummet, lead times are shortened, and the margin per vehicle increases. And that’s exactly what fuels the North Star Metric.

Three numbers. Anyone in the company can look at them and understand if the strategy is working.

Go-to-market strategy

Let’s move up a level in the One-Pager Focus. Here, we define how we reach the market.

One of the most useful ways to identify your ideal customer isn’t to construct a classic persona with age, income, hobbies, and “what they do in their spare time.” That stuff is ridiculously fake. No one buys a car because they’re 42 and live in the countryside.

People buy when they have a job to do : a concrete situation where they want to make progress and something is preventing them. The best way to describe an ideal customer is to describe that moment. When I find myself in this situation, I want this outcome, so I can achieve this progress.

Ideal client

Geely has two ideal customers, b2c and b2b.

Private consumer

When I need to replace my car and the market is overwhelmed with options, I want a vehicle that is smart, safe, and sustainable without having to compromise.

Fleet manager / company

When I need to renew my fleet and meet increasingly stringent cost, safety, and sustainability goals, I want a partner that covers multiple segments with shared technology and global support, so I can standardize my fleet, reduce TCO, and demonstrate compliance without managing dozens of different vendors.

Measurable promise

5-star safety and L2+ intelligent driving as standard on every model in the group, at the price of a traditional vehicle.

The promise must be measurable by the customer , not the company. “30% lower development costs” is an internal number: no consumer or fleet manager can verify it. The safety stars, however, are public (Euro NCAP, CNCAP). L2+ autonomous driving can be verified on the first test drive. The price is comparable to any competitor. Three dimensions that both the private individual and the company can verify before signing.

Sustainable superiority

“Seven-dimensional” technology ecosystem (autonomous driving, cockpit, E/E architecture, vehicle platform, battery, electric powertrain, super hybrid) combined with Volvo + Geely’s dual safety leadership.

Nella nota #232 ho parlato di un concetto che qui diventa concreto: la superiorità sostenibile è qualcosa che i concorrenti non possono o non vogliono copiare. Geely è l’esempio perfetto.

Why can’t competitors? No other automotive group in the world simultaneously owns a premium Scandinavian brand with 60 years of safety leadership (Volvo), a native premium electric brand (Zeekr), a British supercar brand (Lotus), and a Chinese mass-market brand with the scale to produce 4 million vehicles a year. This ecosystem can’t be bought, built in five years, or replicated through an acquisition. It’s the result of 20 years of intertwined strategic decisions. Toyota has the scale but no European premium brands. Volkswagen has the brands but lacks the speed of NEV innovation. BYD has the speed but lacks the global presence. Each of them has a piece. No one has the combination.

Why don’t competitors want it? Deep brand integration requires something most automotive groups refuse: forcing individual brands to give up their technological autonomy. At Volkswagen, the tension between Audi, Porsche, and the group over shared platforms is well-known. At Stellantis, 14 brands coexist with massive duplication. True sharing means that Volvo’s CTO agrees to use the E/E architecture developed by Zeekr. It means that Lotus uses batteries designed for the Galaxy. For most traditional groups, this is culturally unthinkable. For Geely, it’s the strategy.

What does this mean for the customer? Sustainable superiority isn’t just an internal competitive advantage. It has direct effects on car buyers:

- Volvo safety at every price point. The safety technology developed for Volvo (60 years of leadership, inventor of the three-point seatbelt) is also transferred to the Geely Auto and Galaxy models. Buy a Chinese city car and you’ll get the same safety architecture as a €60,000 Swedish SUV. No other group in the world can offer this.

- Continuous software updates across the entire range. The centralized E/E architecture and AIOS operating system are shared. This means over-the-air updates reach all models, not just the top-of-the-line ones. Your car gets better after you buy it, regardless of the brand you choose.

- Global support network, one brand at a time. A European fleet manager can buy Volvo for executives, Zeekr for salespeople, and Lynk & Co for corporate car sharing. Three brands, a single ecosystem of parts and platforms. Fewer suppliers, less complexity, fewer hidden costs.

- A car for everyone. From the Lotus supercar to the Galaxy city car, from the Zeekr electric sedan to the Volvo estate, customers choose the positioning they prefer, knowing that the same engineering quality is at the core. They don’t have to choose between “the brand I like” and “technology that works.”

Warranty

Lifetime warranty on every vehicle in the group.

Geely Italia launched the European market with a move no competitor has dared: a lifetime warranty on mechanical and electronic components. Not 3 years. Not 5. For life.

A lifetime warranty does two things at once.

On the customer side , it erases all objections in one fell swoop. “It’s a Chinese brand, can I trust it?” Those who don’t trust their technology don’t guarantee it for life. “What if they’re gone in five years?” A lifetime warranty is the biggest gamble a company can make on itself: it must exist, it must be solvent, it must have spare parts. Forever. “Electric is still a gamble!” The manufacturer has already made the bet. You just have to drive.

On the operations side , no one at Geely wants to be the department that pays warranty costs. Engineering must design components that last forever. Quality control must be obsessive, because every defect becomes an expense. The supply chain must choose suppliers based on quality, not price. Service must build a widespread network, because a customer with a lifetime warranty who doesn’t find support is permanently damaging to their reputation. I could go on…

A single guarantee aligns the entire organization.

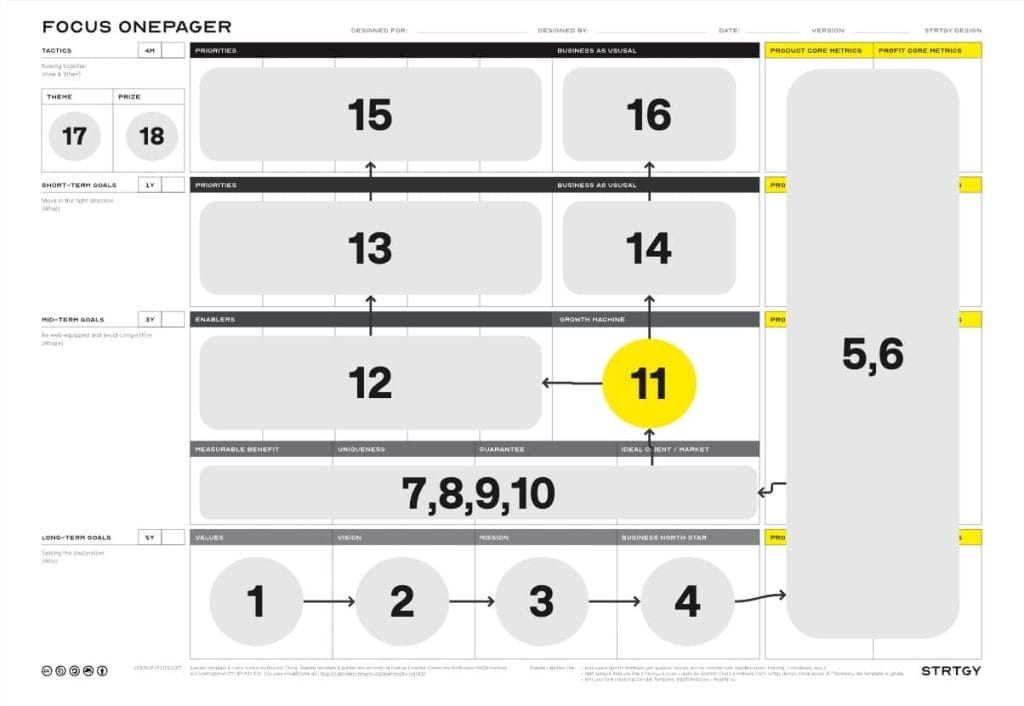

Growth Machine

Now we move to the central part of the Onepager Focus: the growth engine.

A Growth Machine is a self-reinforcing cycle of strategic effects. It’s not a list of objectives arranged in a circle. It’s a sequence of actions where each step almost inevitably generates the next . Each turn accumulates results and execution energy. Each turn makes the next easier, faster, more powerful. Companies that grow sustainably don’t do so thanks to a stroke of genius or a single revolutionary launch. They do so because they’ve built a machine that spins at speeds at which competition becomes irrelevant, and they don’t stop it spinning.

The test to see if your Growth Machine is working is simple: between one gear and the next, you must be able to say, “And this has an inevitable positive effect on …” If the connection is weak, the machine jams.

Geely’s Growth Machine works like this:

Gear 1: Investing in shared technology platforms

Geely develops world-class NEV architectures (from Class A to Class E) that are shared across all the group’s brands. This reduces development costs per model by up to 30% and accelerates launch times. More shared technology means better products, faster.

And this has an inevitable positive effect on …

Gear 2: Launch differentiated products across the brand portfolio

Each brand takes the shared technology and applies it to its segment. Zeekr brings it to premium electric vehicles. Galaxy to the mass market. Volvo to safety and Scandinavian luxury. Lotus to supercars. Seven brands, seven positions, one technological foundation. Each launch costs less and competes better.

And this has an inevitable positive effect on …

Gear 3: Grow global sales

Deep regionalization combined with global collaboration. Volvo opens doors in Europe and the United States. Geely Auto dominates in China. Proton covers Southeast Asia. Each brand leverages its local advantage and the group’s scale. More competitive products in more markets means higher volumes.

And this has an inevitable positive effect on …

Gear 4: Generate economies of scale

Higher volumes reduce unit costs throughout the entire value chain: production, supply chain, and logistics. The freed-up margins are reinvested in R&D and shared platforms.

And the cycle starts again from gear 1. Stronger, every turn.

Strategy doesn’t require a miracle. It requires disciplined steering. Companies that go from being fairly good to being exceptional don’t do so because they’ve found the magic formula. They do it because they find their cycle and never stop running it.

And this discipline is precisely why we’re talking about them! Until recently, no one knew this giant. Now, their growth machine is spinning at such a rapid pace that the market can no longer ignore it.

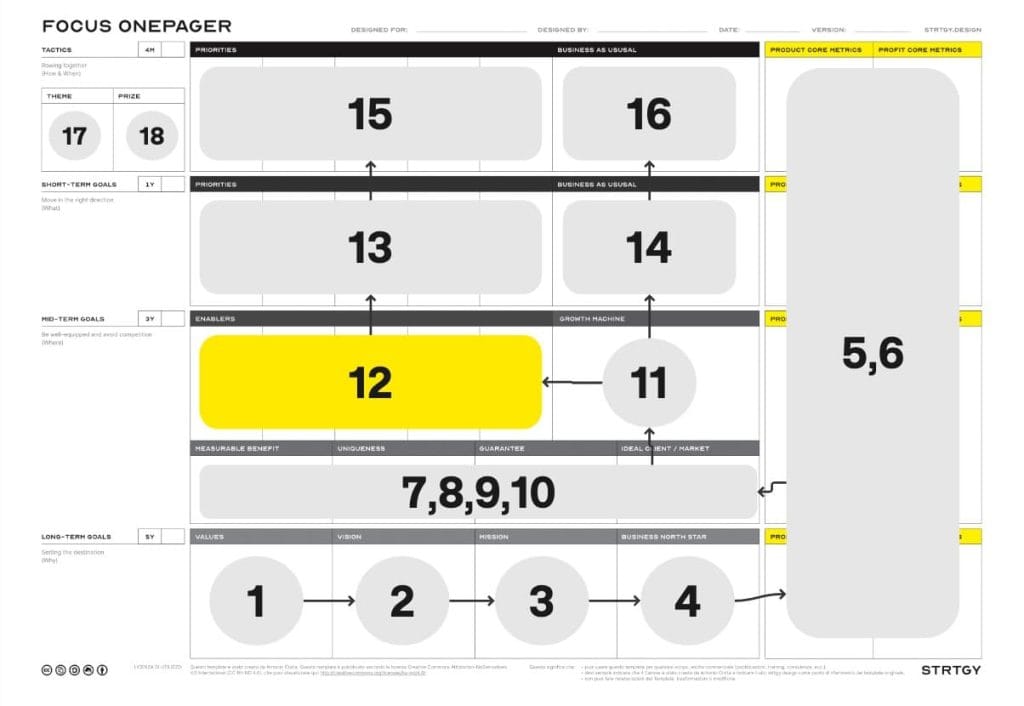

Enablers

Enablers are accelerators, strategic investments that enhance the entire Growth Machine.

Enabler 1: AI and Intelligent Driving

G-Pilot platform from L2 to L4. AIOS operating system with AGI and Agent. The car becomes a super-intelligent product.

Enabler 2: User Services Ecosystem

“Geely Boundless”: services across the entire customer lifecycle. 100,000 customized robotaxis by 2030. Integrated air-ground mobility (drones, ride-hailing, satellites).

Enabler 3: methanol-hydrogen ecosystem

Advantage across the entire value chain: production, transportation, supply, and vehicles. 400+ patents. 50,000+ vehicles already on the road, 23 billion kilometers driven.

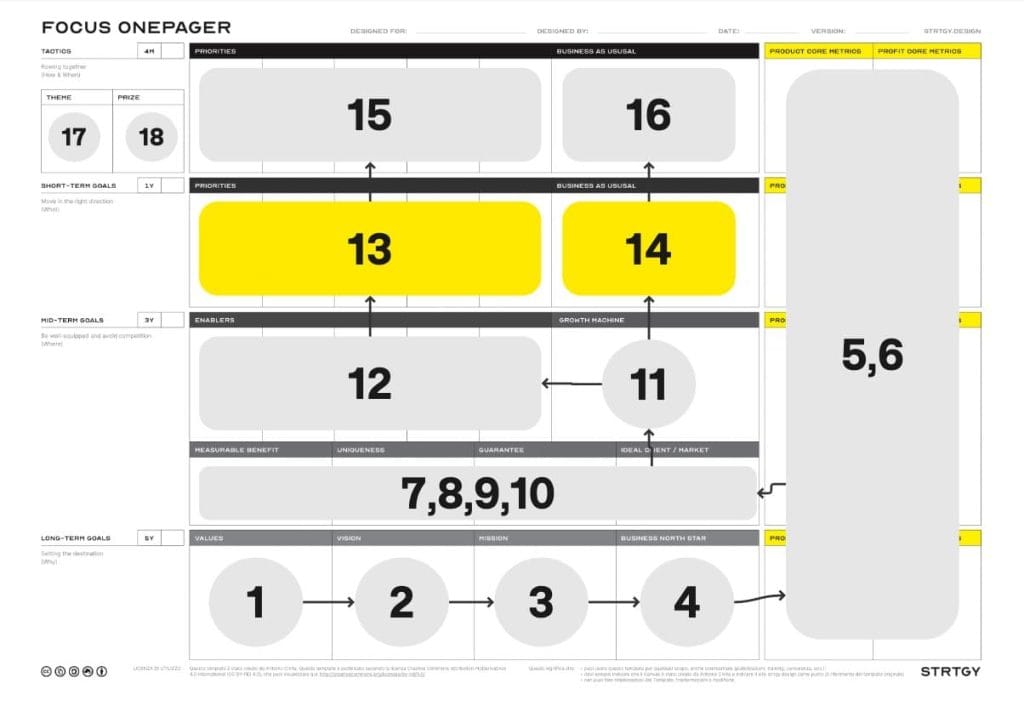

Next 12 months

In the MAKE PROGRESS® method, initiatives are divided into two categories.

Priorities are goals that, if not achieved, would jeopardize the entire strategy. They are not operational activities. They are non-negotiable strategic bets: either you win them, or the plan grinds to a halt.

Business as usual is a different story. Of all the activities already underway, only those requiring optimization in relation to the strategy and the targets to be achieved are highlighted. It’s not a list of “everything we do.” It’s the answer to the question: which of the things we already do need to work better for the strategy to hold up?

Priority:

- AI : Full L2 coverage on all new models, L3 pilots in select cities

- User Ecosystem : “Geely Boundless” Platform Launched, First Robotaxi Fleet Operational

- Methanol-hydrogen : expansion of supply network on key logistics routes

Business as usual:

- Zeekr 8X (super hybrid + BEV) launch

- Launch of i-HEV Intelligent Dual Engine (consumption at 3L/100km)

- Deep regionalization expansion in priority markets

Next 4 months

Priority:

- AI : G-ASD system release with VLA+WAM models

- User Ecosystem : Hardware infrastructure setup for services

- Methanol-hydrogen : first tests on construction machinery and generators

Business as usual:

- Zeekr 8X Pre-Launch and i-HEV Launch Campaign

- Recruiting young talent program (initial RMB 50 million)

- Onboarding new partners for market expansion

What did you just see?

A five-year strategy compressed into one page.

Each section is a decision. Each decision has a place. Each place has a number.

And what I want you to understand more than anything else is this: the exact same tool works for a group of 200,000 people as it does for a team of 3. The strategy doesn’t change in substance, it changes in scale.

Whether you’re managing a portfolio of seven automotive brands or an agency with two employees, the questions are the same: what is your vision, what is the number that predicts your success, how does your growth engine work, what accelerates everything…

The difference between those who make progress and those who remain stagnant isn’t size. It’s clarity.

Reply to this email and tell me.

That’s all for this week.

ALWAYS MAKE PROGRESS ●↑

Antonio